Before College

Know the Costs & the Benefits

Is college worth it for you? Here's what you need to know to make a smart, informed decision.

You don’t have to know exactly what your future looks like, but starting to explore your options now gives you more control later. Whether you’re dreaming of college, curious about apprenticeships, or thinking of a different path, the key is knowing what’s out there and what works for you.

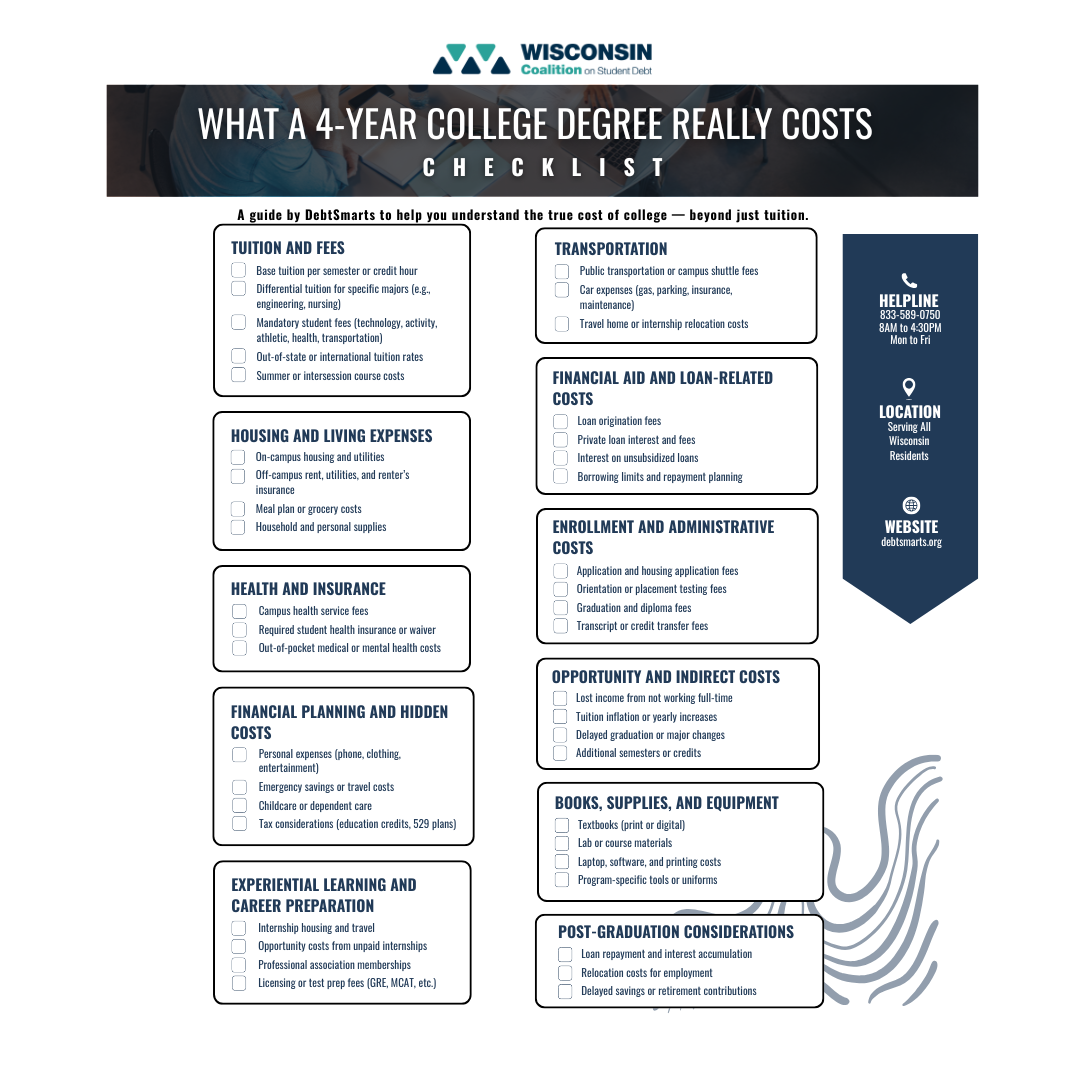

Know What College Really Costs

Don’t let hidden expenses catch you off guard.

Use our College Cost Checklist to plan ahead for tuition, housing, fees, and more.

Need Help Deciding?

You don’t have to go it alone. If you're feeling stuck or overwhelmed:

✅ Talk to your school counselor

✅ Reach out to a local college access program

✅ Get help from a Coalition member: FAFSA, budgeting, scholarships, college & career

✅ Explore the free tools at the bottom of this page

✅ Or simply fill out the form below — we’ll point you in the right direction

Free Tools to Help You Decide

FAFSA

Free Application for Federal Student Aid. Everyone considering college should fill this out.

Tuition Tracker

This is a tool you can use to learn the relationship between what colleges say their tuition is and the actual costs of attending a given college. You can compare colleges using your family’s income to see what students like you paid in the past and might expect to pay now.

College Navigator

Use this free federal tool to explore over 7,000 schools — programs, costs, and outcomes.

Plan Your Path After High School

Not sure what comes next? Fill out this quick form to get free, personalized resources and advice — whether you're thinking about college, training programs, or other options. We'll guide you based on your interests, goals, and questions.