Money Smart Essay Contest

Application Deadline: March 6, 2026

Money Smart week is April 6-12, 2026

Win a College Scholarship

In celebration of Money Smart Wisconsin (April 6 - 12, 2026), the Wisconsin Coalition on Student Debt, along with its partner organizations, is excited to announce the 7th annual Money Smart 2026 Scholarship Contest. We invite Wisconsin's graduating high school seniors to participate by answering this year's Money Smart Question for a chance to win one of several $1,000 scholarships in the form of a contribution to a new or existing Edvest 529 college savings plan account.

How do you plan to be money smart and future ready?

Student loan debt in Wisconsin for students who graduated with a bachelor’s degree in 2025 averaged $32,619. About two-thirds of all college students take out loans to pay for their educational costs.

We are eager to learn about your plan to finance your college education. Through your essay, demonstrate your ability to think critically, plan realistically, and show how you are preparing for the financial responsibilities of college and beyond.

THE 2026 ESSAY QUESTION

(Word limit: 1,500)

Write the essay, referencing where you plan to attend college and the program of study you intend to pursue. Share your vision of your college journey by addressing the following prompts:

1. Planning for College Costs

Start by estimating your total cost of attendance, including tuition, housing, meals, textbooks, technology fees, transportation, and other related expenses. You may use tools such as the U.S. Department of Education’s Net Price Calculator to obtain accurate estimates.

2. Financing Your Education

Once you have outlined the costs, describe your strategy for funding your education. Discuss the resources you plan to use to make college affordable, such as grants, scholarships, financial aid, employment, or family support.

3. Financial Aid Process

Have you completed the Free Application for Federal Student Aid (FAFSA)? Explain the impact completing the FAFSA has on your overall financial plan.

4. Managing Student Loan Debt

If student loans are part of your plan, explain how you will keep your debt manageable. Compare your potential student loan debt and estimated payments to the salary you expect to earn in your chosen career. Discuss how you plan to manage student loan debt responsibly in relation to your future income and how this will shape your life in the years following graduation.

5. Balancing Responsibilities

Describe how you will balance your finances, academic workload, and any job responsibilities while staying focused on your academic and career goals.

STUDENT GUIDELINES

CANDIDATE MUST:

Be a Wisconsin resident

Be a graduating high school senior

Plan to attend a Wisconsin college or university

Student or parent/guardian must have a valid Social Security Number

Demonstrate basic money management knowledge

TO APPLY:

Submit a concise essay written by the student

Essay must be original and NOT AI-generated

Complete the Money Smart Scholarship Application

Application must be signed by both the student and a parent/guardian

Essay and signed application must be combined into one PDF (or scanned attachment)

Email submissions to: MoneySmart@debtsmarts.org

IMPORTANT INFORMATION

Direct all questions to: MoneySmart@debtsmarts.org

(Attn: Cheryl Rapp)Winners’ names may be shared with their high school for recognition at award ceremonies

Award recipients will only be notified between April 6–21, 2026

All submitted essays become the property of the WI Coalition on Student Debt and may be used to promote financial literacy

All submissions must be received before midnight on March 6, 2026.

Thank you to our Money Smart Wisconsin 2026 Sponsors:

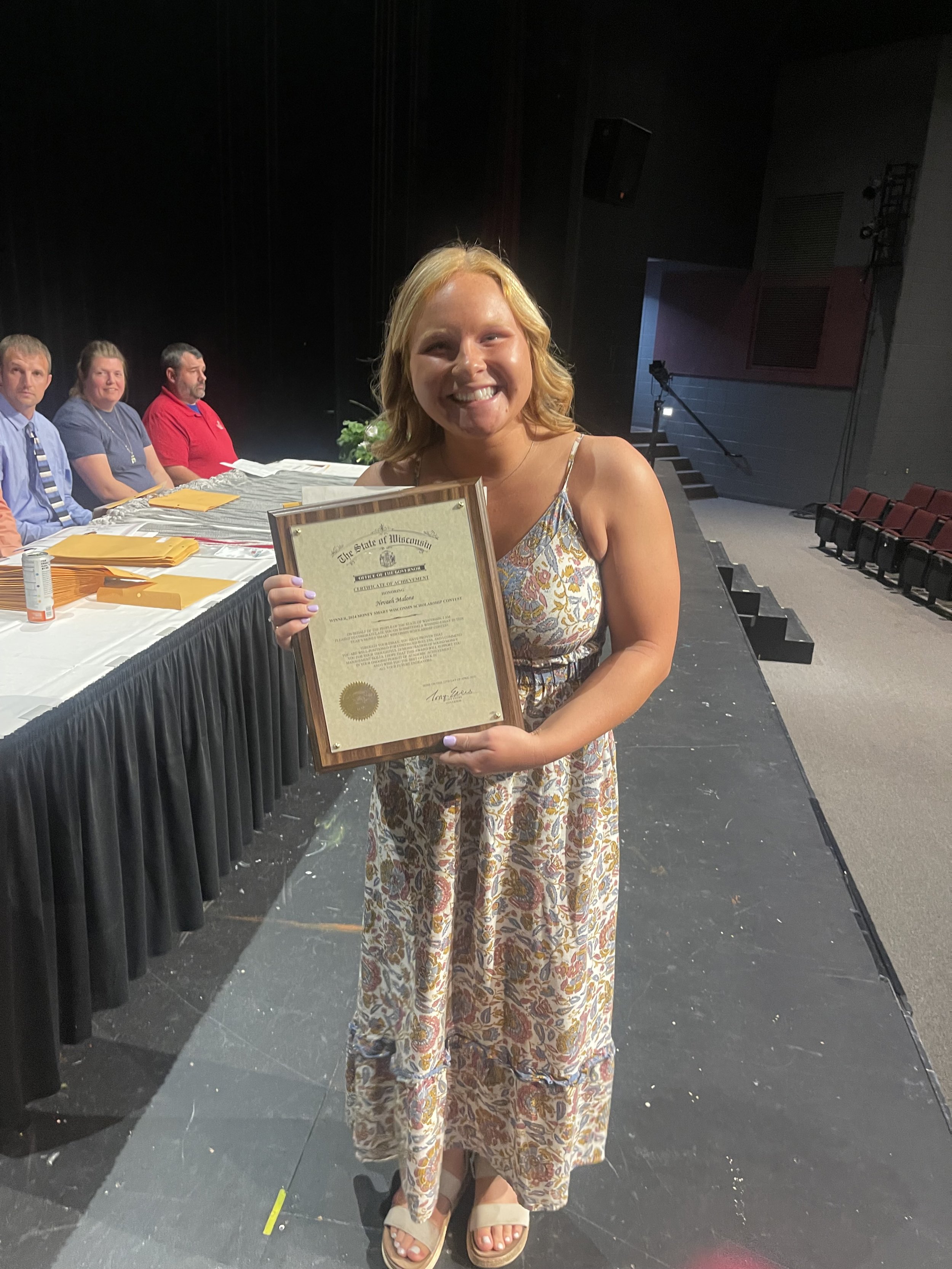

2025 Money Smart Scholarship Winners

Fifteen Wisconsin high school seniors were awarded $1,000 each for their winning essays on how they plan to finance their college education and career training.

2024 Money Smart Contest Winners

The scholarship recipients demonstrated thoughtful college planning and thinking about budgeting. Read more about it on the Wisconsin Department of Financial Institutions news release.