Student debt relief scams on the rise. Here’s what borrowers need to know.

BY: CASEY QUINLAN -

The Wisconsin Examiner

In Default and Left Behind: How Higher Education and the Student Loan System Are Failing the Most Vulnerable Borrowers

New report released from @NewAmericaEd By: Sarah Sattelmeyer, Tia Caldwell

On findings from 50 borrowers from across the country who reported holding federal student debt and defaulting on their loans before the COVID-19 pandemic.

You can access the full report on their website.

Press Release: Justice Department and Department of Education Announce a Fairer and More Accessible Bankruptcy Discharge Process for Student Loan Borrowers

At a Glance: Department of Justice’s New Process for Student Loan Bankruptcy Discharge Cases

Each year, individuals in the bankruptcy process seek to discharge student loan debt in order to get the “fresh start” envisioned by the bankruptcy code. Congress has set a higher bar for discharging student loan debt compared to other debt—debtors who seek to discharge student loans must prove in a separate “adversary proceeding” that paying their student loans would impose an “undue hardship.” But that higher bar need not be an insurmountable barrier for debtors who cannot afford to pay their student loans.

The Department of Justice, in close coordination with the Department of Education, is implementing a new process at the outset of adversary proceedings in which debtors seek to discharge federal student loans in bankruptcy. While the bankruptcy judge makes the final decision whether to grant a discharge, the Justice Department can play an important role in that decision by supporting discharge in appropriate cases. The new process will help ensure transparent and consistent expectations for the discharge of student loan debt in bankruptcy; reduce the burden on debtors of pursuing such proceedings; and make it easier for Justice Department attorneys to identify cases where discharge is appropriate.

Under the Justice Department’s new process, debtors will complete an attestation form to assist the government in assessing the discharge request. The Justice Department, in consultation with the Department of Education, will review the information provided, apply the factors that courts consider relevant to the undue-hardship inquiry, and determine whether to recommend discharge. Even where the applicable factors may not support a complete discharge, where appropriate, the Justice Department will consider supporting a partial discharge. Read the full press release here.

Where the Weaknesses Are in Student Financial Wellness

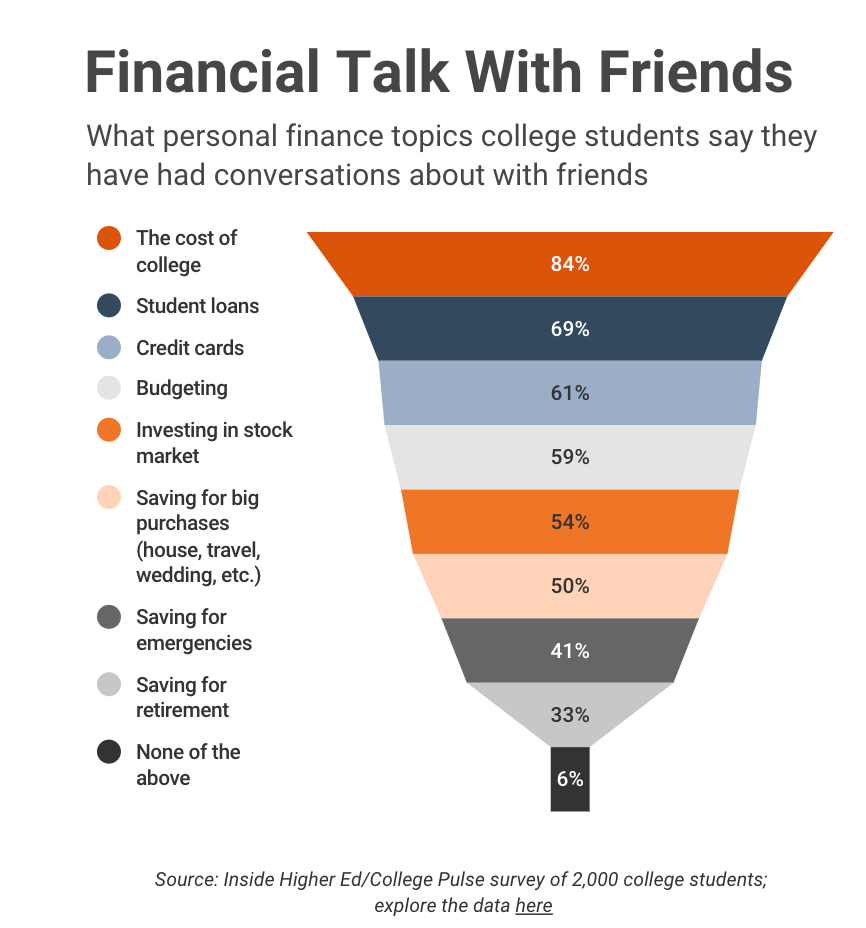

A survey of students’ personal finance realities reveals the need for stronger financial literacy education and support.

By Melissa Ezarik

February 25, 2022

One reality has become clear in Paul Goebel’s 16 years as director of the Student Money Management Center at the University of North Texas: individuals have different levels of tolerance for debt.

One nontraditional student “was a quarter million dollars in debt—but she wasn’t losing sleep over it. I was losing sleep when I looked through the notes on her account, but when I met the woman, she had a great attitude,” he said. She recognized her mistakes but calmly vowed to get out of debt.

Another student—the same day—arrived and shared, through tears, that she might need to withdraw. “Her parents had given her a credit card for emergencies, and guess who made the choice to become the most popular person on her floor?” he explained. Handing her some tissues, he asked how bad the balance was. Bad, she said. “Five.” “Five thousand?” And she said, “No, that’s crazy! Five hundred!”

You can read the full article from Inside Higher Ed here.

Why Veterans With GI Bill Benefits Still Take Out Student Loans

More than half of borrowers used bulk of borrowed money to cover living expenses, survey shows.

January 7, 2022 By: Phillip Oliff, Scott Brees & Richa Bhattarai

Nearly 6 in 10 U.S. military veterans who have taken out student loans cite living expenses, such as housing and child care, as their main reason for borrowing, according to a first-of-its-kind, nationally representative survey of veterans who have taken out student loans. READ MORE

Free-Falling FAFSAs

From the Wisconsin Policy Forum

Focus #17 • September 2021

The percentage of Wisconsin high school seniors completing the Free Application for Federal Student Aid (FAFSA) plummeted during the pandemic, which likely signals a concerning trend for college enrollment. The declines hit underserved groups the hardest, eroding previous years’ progress toward closing FAFSA completion gaps.

Amid the chaotic conditions of COVID-19, fewer seniors at Wisconsin high schools filled out a key federal financial aid form, with the number of completions falling by 6.3% from 2019 to 2020 and 12.2% from 2019 to 2021. The declines were greater than the national drops of 3.2% from 2019 to 2020 and 7.8% from 2019 to 2021, according to our analysis of data published by the Federal Student Aid Office at the U.S. Department of Education. Read the full report here.

Public Service Loan Forgiveness Program (PSLF) Overhaul

On October 6, 2021, the US Department of Education announced a set of actions intended to “move away from the current situation in which too few borrowers receive forgiveness, and too many do not receive credit for years of payments they made because of complicated eligibility rules, servicing errors or other technicalities.”

You can read the Fact Sheet with more complete details at the

US Department of Education website.

These actions include:

Implement a Limited PSLF Waiver to count all prior payments made by student borrowers toward PSLF, regardless of loan program. The waiver will run through October 31, 2022.

Simplify what it means for a payment to qualify for PSLF.

Eliminate barriers for military service members to receive PSLF.

Automatically help service members and other federal employees access PSLF.

Review Denied PSLF Applications and Identify and Correct Errors in PSLF Processing.

Improve Outreach and Communication with PSLF-Eligible Borrowers.

Simplify the PSLF Application Process.

Make Long-Term Improvements to PSLF through Rulemaking.